Containership speeds have peaked to an average of 20 to 25 knots, and it is unlikely that speeds will increase due to energy consumption

The first generation of containerships was composed of modified bulk vessels or tankers that could transport up to 1,000 TEUs. The first containership, the “Ideal-X” was a converted World War II T2 tanker. While the industry as such has been around since 1956, when the converted oil tanker IDEAL X was turned into the world's first container ship and set sail on a US domestic trip from Newark to Houston, At the beginning of the 1960s, the container was a transport technology being tested and gradually deployed, and reconverting existing ships proved to be of lower costs and less risky. These ships were carrying onboard cranes since most port terminals were not equipped to handle containers. They were also relatively slow, with speeds of about 18 to 20 knots, and could only carry containers on the converted decks and not in their bellyhold.

At the beginning of the 1970s

Once the container began to be massively adopted at the beginning of the 1970s, the construction of the first fully cellular containerships (FCC; second generation) entirely dedicated to handling containers started. The first cellular containerships, called the C7 class, were introduced in 1968. All containerships are composed of cells lodging containers in stacks of different heights depending on the ship’s capacity. Cellular containership also offers the advantage of using the whole ship to stack containers, including below deck.

Cellular containerships

Usually, an extra two containers in width can be carried above deck than below deck. Cranes were removed from the ship design so that more containers could be carried (cranes remain today on some specialized containerships). The ability of ports to handle cellular containerships ceased to be a major concern with the setting of specialized container terminals worldwide. Cellular containerships were also much faster, with speeds of 20-24 knots, which would become the speed of reference in containerized shipping.

Alphaliner is looking back at 25 years of container shipping

Meanwhile Alphaliner is looking back at 25 years of container shipping. We will illustrate how the fleet has grown and how the setup of the top ocean carriers has changed. it has been the last 25 years that have seen the sector achieve unprecedented growth

The once modest container fleet ballooned

Within the time of one ship's commercial life, about 25 years, the once modest container fleet has ballooned from 4.5 Mteu to 33.6 Mteu today. Organic growth and a wave of consolidation in the 2010s have moved a whopping 84% of global ship capacity into the hands of the Top 10 carriers, compared to 61% at the start of the millennium Over the past quarter of a century, the number of ships has seen a net increase from 2,622 to 7,492. Average vessel size therewith went up from ca. 1,700 to about 4,500 teu

The world fleet has grown in an almost linear way from 2003 to 2023,

At close to 11.0 Mteu (the exact number depends upon when some 'orders' are counted as firm), today's newbuilding pipeline alone is more than twice as big as the world fleet was in 2000.Alphaliner data shows that the world fleet has grown in an almost linear way from 2003 to 2023, with net capacity increases of about 1 Mteu per year, or 20 Mteu over 20 years. Over the course of the last two years, however, fleet growth has accelerated notably, with well over 2 Mteu per year injected into the liner fleet.

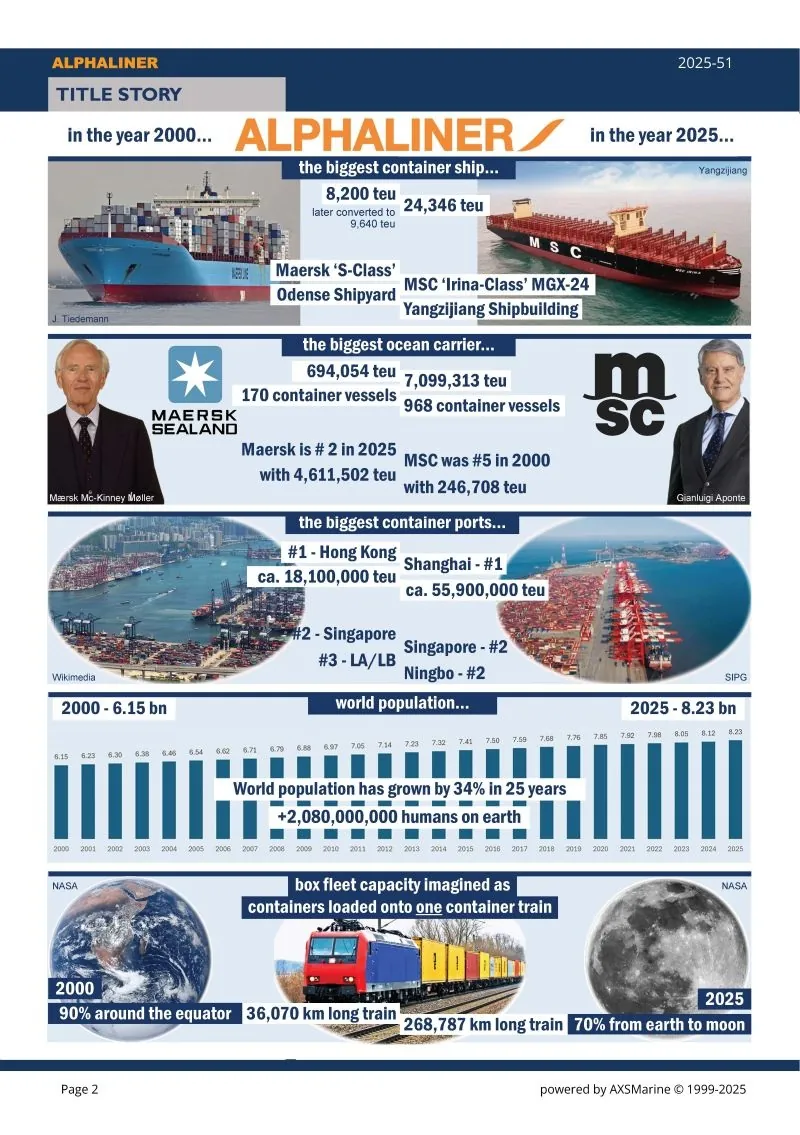

Alphaliner’s latest weekly report features some significant numbers to gauge the development of the container shipping industry over the last 25 years. Starting from the comparison between the world population of 2000 (6.15 billion people) and of 2025 (8.23 billion) – growth of 34% – the analysis company has highlighted the explosion of the overall hold (from 4.51 to 33.6 million TEU), that of the number of container ships (from 2,622 to 7,492), of the average hold capacity (from 1,700 to 4,500 TEU), of the market concentration (with the first 10 carriers going from holding 61 to 84% of the world hold), of the orderbook (11 million TEU, equal to more than twice the fleet of 2000), not without the warning of how the numerical increases are higher than the effective increase in the offer in a broader sense, being 'absorbed' by "slower navigation (generally speeds on the high seas of 16-17 knots, with some routes still slower) and port congestion”

Alphaliner’s latest weekly report

In 2000, Alphaliner also recalls, the largest ships were the Maersk S-Class built in Odense (8,200 TEU), while today they are the MSC Irina Mgx-24 class ships built by the Chinese Yangzijiang shipyard (24,346 TEU), the largest carrier was Maersk with 170 ships for 694,050 TEU of capacity (today second with 4,611,502 TEU), while today it is MSC with 968 ships for 7,099,313 TEU of capacity (it was fifth in 2000 with 246,708 TEU), the largest port was Hong Kong with approximately 18.1 million TEU handled annually (followed by Singapore and Los Angeles – Long Beach) while today it is Shanghai with approximately 55.9 million TEU handled (followed by Singapore and Ningbo), and the existing containers in the world would have covered 90% of the equator (36,070 km) while today they represent 70% of the distance from the Earth to the Moon (268,787 km)

Future Prospects

Containership speeds have peaked to an average of 20 to 25 knots, and it is unlikely that speeds will increase due to energy consumption; many shipping lines are opting for slow steaming to cope with higher bunker fuel prices (when there are market spikes) and overcapacity (to have more ships in a slower service). The deployment of a class of fast containerships has remained on the drawing boards because the speed advantages they would confer would not compensate for the much higher shipping costs. Supply chains have been synchronized with container shipping speeds, and the setting of landbridges, such as the Eurasian landbridge, offers a competitive service for time-sensitive cargoes.

Related : Xeneta releases weekly ocean container shipping market update

#Alphaliner #The world fleet #Top 10 carriers #The evolution of container shipping #cellular containerships # the last 25 years #IDEAL X

You Might Also Like

27 November 2025

Recommendation News

Marine Cultures

Christ in the Storm on the Sea of Galilee from Rembrandt’s works 29 October 2025

Ports

Port Saint John Announces Appointment of New Chief Operating Officer 31 January 2026

Ports

JV : AD Ports Group and Columbia Group Form Ship Management 10 October 2025

Yachts&Cruises

134m Lürssen superyacht Deep Blue will delivery before November 07 October 2025

Marine News Room

IMO and EU launch "Future-Ready Shipping in Africa" project 02 December 2025