Last year, the fleet of the Mediterranean Shipping Company (MSC) grew by over 800,000 TEU. This means that the gap between the world’s largest shipping company and its competitors continues to grow.

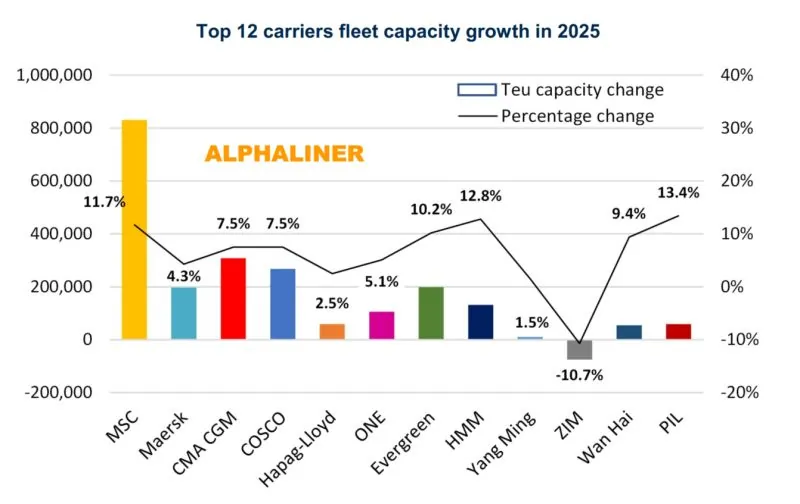

According to new data from industry analyst Alphaliner, the capacity of the liner shipping companies, each of which controls more than 1% of the global fleet, has grown by a total of 2.14 million TEU or 7.3%. The lion’s share is accounted for by MSC: the Swiss company has added a capacity of 831,400 TEU to its fleet, which corresponds to relative growth of 11.7%. Newbuildings alone account for 700,000 TEU: 54 ships were delivered to the company. The Swiss were also more active than average on the second-hand market. The shipping company’s total capacity broke through the 7 million TEU barrier in 2025, and the trend continues to rise.

The closest competitor in the global rankings

By comparison, the Danish shipping company Maersk, the closest competitor in the global rankings with 4.6 million TEU, expanded its fleet by “only” 17 new builds. Capacity grew by 4.3% or 197,000 TEU. The market leader’s already comfortable lead has therefore grown even further with this development.

Related : MSC : Commitment to deploy 12 vessels under the Indian flag

Related : Maersk survey : Expect disruptions to persist for two more years

Other shipping companies

In addition to MSC, other shipping companies also grew strongly in proportion. Evergreen expanded its fleet by 10.2% (21 newbuildings, 198,600 TEU) to a total of 1.95 million TEU and thus continues to occupy seventh place on the list. Eighth-placed HMM from South Korea even recorded growth of 12.8%: The fleet increased by eight newbuildings and 131,400 TEU. The fleet of Wan Hai (eleventh place) grew by 9.4%, while PIL, the last of the top 12, increased its capacity by as much as 13.4%.

Expectation of Alphaliner

While MSC will maintain first place in the coming years, the analysts at Alphaliner expect Maersk to soon vacate second place due to its relatively low growth. The French shipping company CMA CGM, the third-placed shipping company with 4.13 million TEU, expanded its capacity by 7.5% last year. Maersk’s order book comprises around 1 million TEU, while CMA CGM will increase its fleet by approximately 1.8 million TEU. However, Alphaliner does not expect the French company to overtake Maersk in the current year.

By the end of 2025

By the end of 2025, no other carrier has increased it fleet as much as the Geneva-based company.Over the course of 2025, MSC further widened the gap with other container ship -owners. This is according to a recent Alphaliner report, which highlighted how the combined capacity of the twelve carriers that individually control more than 1% of the global fleet increased by 7.3% over the past twelve months. These operators collectively added 2.14 million TEUs to their fleets in 2025.

The Geneva-based carrier widened the gap

MSC added 831,400 slots, accounting for 39% of the growth of the top 12 lines. With this 11.7% capacity increase in 2025, the Geneva-based carrier widened the gap with second-place A.P. Moller-Maersk, bringing it from 1.9 million TEUs a year ago to 2.5 million TEUs. The group controlled by the Aponte family had already been the carrier with the highest growth in 2024 (+10.3%), 2023 (+22.0%), 2022 (+7.5%), and 2021 (+10.7%). The expansion of the Geneva fleet in 2025 was primarily driven by newbuilding tonnage: MSC added 54 new ships, for a total of 695,185 additional slots per TEU.

Other carriers recorded above-average market growth in 2025,

Other carriers recorded above-average market growth in 2025, including Evergreen Line (+10.2%), HMM (+12.8%), Wan Hai Lines (+9.4%), and Pacific International Lines Ltd (+13.4%). Zim Integrated Shipping Services was the only company in the top 10 to reduce capacity (-10.7%), after several years of rapid expansion driven by newbuilding deliveries.

This year's movements suggest further changes in the ranking, with the third-largest liner, CMA CGM (4.13 million TEUs), closing the gap with Maersk (4.61 million TEUs). The French company expanded its fleet roughly in line with the market average (+7.5%), while its Danish competitor's growth was limited to 4.3%. However, based on operators' current orderbooks, it is unlikely to overtake in 2026.

MSC drives fleet growth

Meanwhile MSC led the expansion, adding 831,400 TEU, accounting for 39% of the top 12 carriers’ fleet growth. This 11.7% capacity increase has extended the gap between MSC and second-ranked A.P. Moller – Maersk to 2.5 million TEU, up from 1.9 million TEU a year earlier. The Aponte family-controlled carrier has maintained strong growth in recent years, with annual increases of 10.3% in 2024, 22% in 2023, 7.5% in 2022, and 10.7% in 2021.

Newbuilds and acquisitions fuel expansion

MSC’s fleet expansion in 2025 was driven primarily by newbuild vessels, with 54 ships adding 695,185 TEU. The remainder of the growth came from second-hand vessel acquisitions.

Looking ahead: Rankings and market trends

Looking ahead, CMA CGM, the world’s third-largest carrier at 4.13 million TEU, has been closing the gap with Maersk (4.61 million TEU). While CMA CGM’s growth of 7.5% in 2025 was in line with the market average, Maersk’s expansion slowed to 4.3%. Based on current vessel orderbooks, analysts do not anticipate a change in rankings in 2026.

Related : CMA CGM: Financial results for the Third Quarter 2025

# CMA CGM #MSC #HMM #Evergreen #Maersk #Alphaliner #The gap #liners in container

You Might Also Like

Recommendation News

Seafarers

ITF : Seafarers must be at the heart of shipping’s climate transition 29 October 2025

Marine Tech

ABS and AMOG Sign MOU to Advance Offshore Mooring Digital Twin Technology 14 January 2026

Marine Tech

I-Tech and Havey sign MoU to collaborate on the development antifouling materials 24 November 2025

Shipping Lines

MSC : Commitment to deploy 12 vessels under the Indian flag 06 November 2025

Ports

Mawani and ARASCO sign SAR grain-logistics deal at King Abdulaziz Port 08 December 2025