The French company reserves the right to change prices on a quarterly basis depending on fluctuations in CO2 prices.

Following Hapag Lloyd, CMA CGM has also informed customers that the costs of the (EU -ETS ) (Emission Trading System)that will affect its operations and our Energy Transition Surcharge surcharge will increase starting January 1st. The reason is that, under the gradual implementation mechanism desired by Brussels for the regulation, from January 1st emitters will no longer be required to pay for 70% of the carbon dioxide produced, but for 100%: "Following this change, we expect the current ETS surcharge amounts to increase by approximately 43%.

Requirements of the EU ETS

The EU ETS requires carriers to monitor and report CO2 emissions on voyages to and from EU ports, with a portion of these emissions already subject to a cap-and-trade system designed to accelerate emissions reductions across the maritime sector.

CMA CGM reserves the right to revise

The exact amount, however, is still being finalized, and CMA CGM reserves the right to revise it as the process progresses: "Please note that this estimate does not take into account potential fluctuations in CO2 prices, which could further impact the final surcharge amounts. The amounts for the first quarter of 2026 for the entire commercial coverage covered by the EU ETS will be available by December 1, 2025."

Related : CMA CGM: Financial results for the Third Quarter 2025

In 2026, the EU ETS will apply to 100 per cent of our CO2 emissions

Where beginning in 2026, the EU ETS will apply to 100 per cent of our CO2 emissions — up from 70 per cent in 2025 — and will also cover additional GHG. This expansion will materially impact our cost structure, and we currently anticipate an approximate 43 per cent increase in ETS surcharge levels. This estimate does not account for potential fluctuations in CO2 prices.Q1 2026 surcharge amounts for all trades covered by the EU ETS will be published on 1 December 2025.

Regulatory changes

These regulatory changes underscore the EU’s continued commitment to climate action and a lower-carbon future. CMA CGM noted that it will maintain full transparency as the framework evolves. Recently, CMA CGM expanded its barge network in Northern Vietnam with the launch of a new Que Vo > Haiphong service.

The EU ETS is based

It is noteworthy that The EU ETS is based on a “cap and trade” principle. The cap refers to the limit set on the total amount of GHG that can be emitted by installations and operators covered under the scope of the system. This cap is reduced annually in line with the EU’s climate target, ensuring that overall EU emissions decrease over time. By 2023, the EU ETS has helped bring down emissions from European power and industry plants by approximately 47%, compared to 2005 levels.

The EU ETS cap is expressed in emission allowances with one allowance giving right to emit one tonne of CO2 eq (i.e., carbon dioxide equivalent). Allowances are sold in auctions and may be traded. As the cap decreases, so does the supply of allowances to the EU carbon market.

Under the system, companies must monitor and report their emissions on a yearly basis and surrender enough allowances to fully account for their annual emissions. If these requirements are not met, heavy fines are imposed.

The EU ETS ,CMA CGM , Hapag Lloyd , 43% ETS surcharge , EU ports, CO2 emissions , CO2 prices , EU carbon market.

You Might Also Like

14 October 2025

Recommendation News

Shipping Lines

CMA CGM's Türkiye-USA container service will also call at Salerno- Italy 11 January 2026

Ports

Suez Canal : Transit of the giant container ship CMA CGM JACQUESSAADE and MAERSK SEBAROK 23 December 2025

Marine News Room

Osama Rabie : The top 100 influential figures according to Lloyds List 10 December 2025

Marine Tech

RINA successfully tests line pipe hydrogen suitability for Jindal 15 October 2025

Seafarers

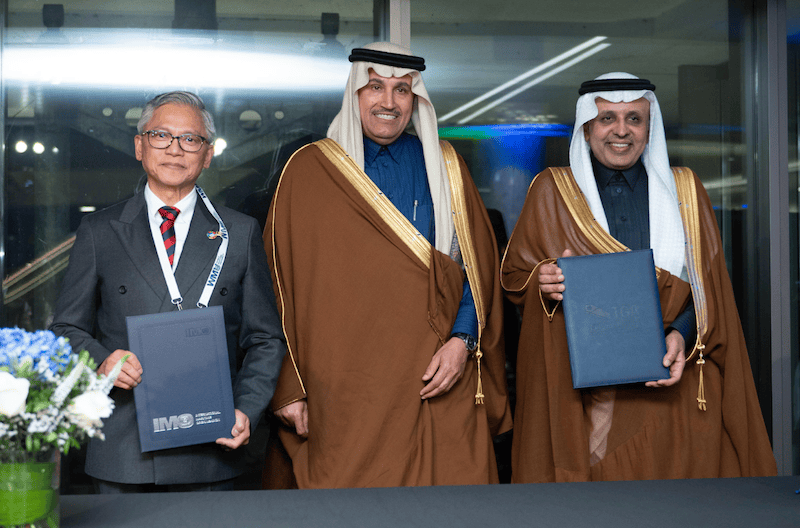

WMU Launches New Project on the Abandonment of Seafarers with Support from Saudi (TGA) 12 December 2025