Ensure that the agreement contributes to long-term national development, economic resilience, and operational reliability with a combination of strategic planning, thorough analysis, and strong regulatory oversight.

By : Suraya Yeasmin Jui

MSc in Maritime Affairs

(World Maritime University, Malmö, Sweden)

Terminal Officer, Chittagong Port Authority

Public–private partnerships in the port sector can unlock large investments, improve efficiency, and introduce world-class operational standards. Yet a concession agreement is not simply a business deal—it is a 20–30-year commitment that shapes a country's trade competitiveness. When governments or port authorities rush into these agreements without adequate due diligence, the consequences can be long-lasting and extremely costly. For this reason, the ground work completed before signing the agreement is equally as important as the contract itself.

Preparing the Ground Before the Agreement

The port authority represents the public interest, making its responsibilities the most critical in the concession negotiation process. Its primary obligation is to ensure that the agreement contributes to long-term national development, economic resilience, and operational reliability. Achieving this requires a combination of strategic planning, thorough analysis, and strong regulatory oversight.

The port authority must begin by developing a realistic and independent assessment of cargo demand. Traffic forecasts form the foundation of every concession, influencing investment size, tariff structures, financing terms, and capacity planning. Overestimation can lead to overcapacity, while underestimation may restrict future growth. For this reason, the authority must rely on neutral analytical models rather than projections supplied solely by private parties or political expectations.

Financial structuring is another major responsibility

Financial structuring is another major responsibility. The authority must evaluate whether the proposed financial model is bankable, sustainable, and aligned with market conditions. This includes assessing interest rate assumptions, foreign exchange exposure, construction costs, projected cash flows, and revenue-sharing mechanisms. The government or authority must also determine whether the concession fee structure—fixed, variable, or hybrid—appropriately balances public revenue with operator viability. Failure to do so may compromise national earnings for decades.

Risk allocation must be addressed with equal care. The port authority must define responsibilities for construction, dredging, equipment procurement, maintenance, safety compliance, and environmental management. If obligations are unclear, the public sector may find itself liable for additional costs, delays, or unforeseen risks.

Regulatory strength is another essential pillar.

Regulatory strength is another essential pillar. Even after signing the concession, the port authority remains responsible for regulating tariffs, ensuring fair market access, protecting labour and environmental standards, and monitoring operational performance. A concession should never diminish the authority’s regulatory mandate; instead, it should enhance the framework through which performance is measured.

Another important aspect is the development strategy of the terminal itself. When the entire project is constructed at once without aligning capacity with actual demand, the financial burden becomes heavy, especially in the early years. Phased development provides flexibility, aligns investment with market growth, and strengthens financial feasibility. It also allows both partners to adapt to evolving trade patterns and operational realities.

The port authority must safeguard strategic control.

Finally, the port authority must safeguard strategic control. A port is a national asset that affects trade, security, and economic policy. The concession must therefore preserve the authority’s ability to plan future expansions, adjust infrastructure priorities, and maintain national competitiveness. No agreement should grant an operator unchecked control or limit the authority’s long-term policy flexibility.

Consequences of a Poorly Crafted Concession Agreement

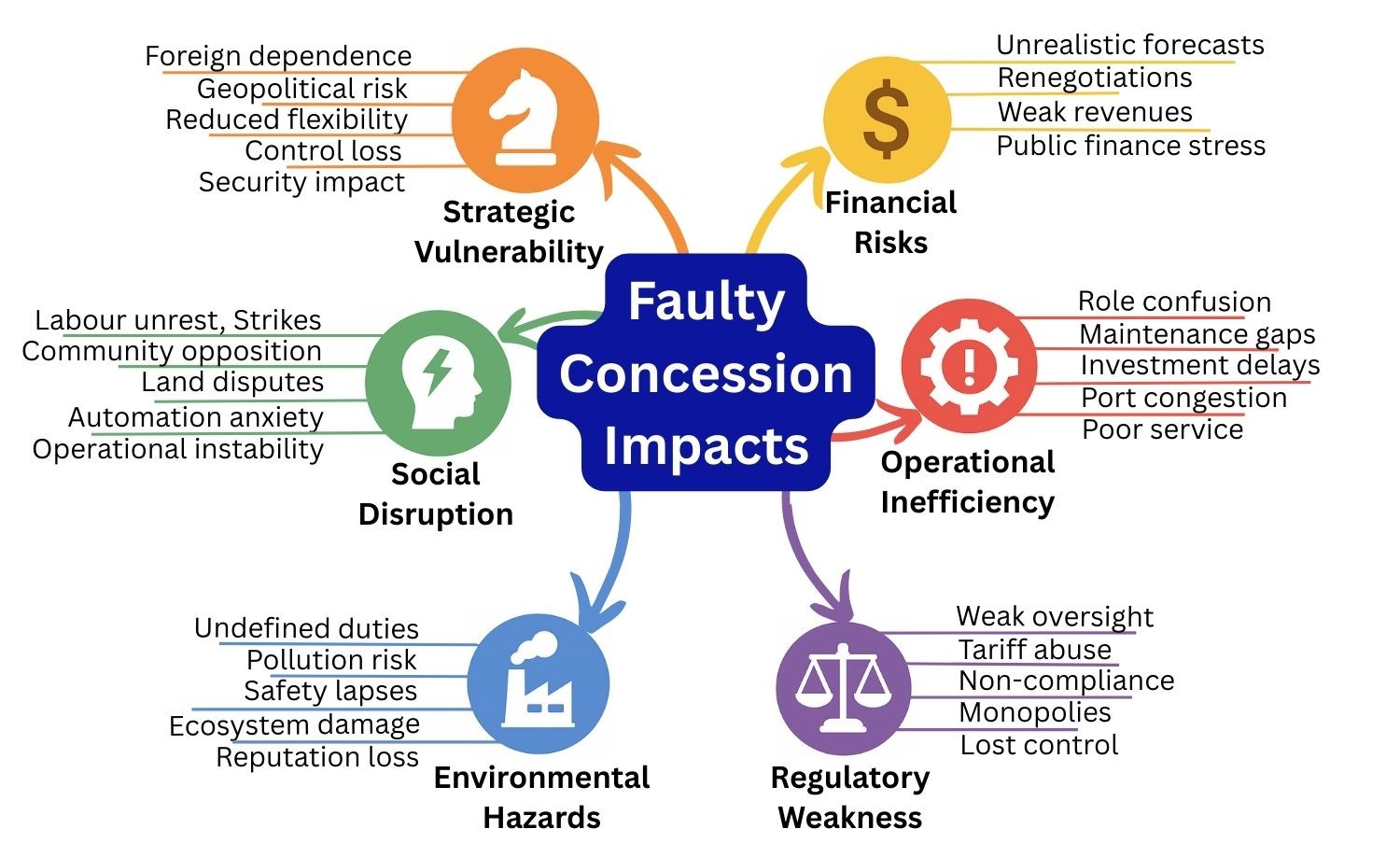

When a concession agreement lacks clarity, balance, or careful planning, the consequences can be far-reaching—affecting not only the port itself but also trade competitiveness, public finances, and national development.

One of the most common consequences is financial stress. A concession agreement that is built on weak financial foundations can expose the government or port authority to significant long-term risks. When traffic forecasts or financial assumptions are unrealistic, the project may fail to generate the revenue needed to sustain operations, prompting the operator to seek renegotiation of fees, extended grace periods, or revised obligations. Poorly defined revenue-sharing or royalty structures can further limit public income, while inadequate safeguards leave the authority vulnerable to interest rate volatility, foreign exchange fluctuations, and refinancing pressures. Together, these weaknesses can place the public sector under financial stress, undermine the stability of the concession, and reduce the economic value the agreement was meant to deliver.

Unclear obligations can lead to disputes

Operational inefficiencies may also arise if responsibilities are poorly allocated. Unclear obligations can lead to disputes over maintenance, construction delays, or insufficient investment in equipment and technology. This can cause congestion, long vessel turnaround times, and deterioration in service quality—directly affecting trade competitiveness.

A weak legal and regulatory framework can seriously undermine the effectiveness of a port concession. Without strong oversight, an operator may set tariffs that reduce trade competitiveness or adopt practices that fall short of required safety, labour, or environmental standards. Insufficient regulation also increases the risk of long-term monopolistic behaviour, limiting fair market access and undermining the port’s strategic flexibility. In such situations, the port authority may gradually lose effective control over its core assets, restricting its ability to enforce policies, implement improvements, or guide the port’s long-term development.

Social and environmental risks form another critical dimension

Social and environmental risks form another critical dimension of port concession agreements, and inadequate planning in these areas can lead to serious disruptions. When labour interests are not properly considered, port workers and unions may resist privatization, triggering strikes, operational slowdowns, or prolonged unrest that compromises the terminal’s stability. Community concerns also require careful attention; poorly managed land acquisition or insufficient consultation can lead to public opposition, legal challenges, and costly delays. At the same time, modern port operations increasingly rely on automation, and without clear policies for workforce transition and reskilling, technological upgrades can create anxiety and resistance among the labour force.

Environmental and maritime safety responsibilities

Environmental and maritime safety responsibilities are equally important. If the concession agreement does not clearly define environmental obligations, private operators may under-invest in essential areas such as waste handling, emissions control, spill prevention, and navigation safety measures. This can heighten the risk of accidents, pollution incidents, or damage to marine ecosystems—events that not only carry significant financial consequences but can also severely damage the reputation of the port authority. Failure to maintain international environmental and safety standards can further expose the government to scrutiny from global regulators, trade partners, and environmental bodies. Together, these social, labour, and environmental weaknesses can undermine operational continuity, increase long-term costs, and diminish public trust in the concession model.

The loss of national strategic control

The loss of national strategic control is a critical concern when managing port concessions, as ports serve as vital gateways for both national security and international trade. Over-reliance on a single foreign operator can create vulnerabilities, leaving the country exposed to external pressures and limiting its ability to respond effectively to unforeseen geopolitical or economic challenges. Furthermore, poor planning or inadequate contractual safeguards can restrict the flexibility of the national logistics strategy, undermining the capacity to optimize supply chains or respond to shifting trade patterns. In addition, if a concessioned operator underperforms or fails to meet agreed standards, reclaiming operational control can be complex, costly, and politically sensitive, potentially causing long-term disruption to national commerce and security interests. Ensuring robust governance, diversified operational partnerships, and clear legal mechanisms is therefore essential to safeguard the strategic autonomy of the nation’s ports.

Powerful opportunities for modernization and growth

In conclusion, concession agreements offer powerful opportunities for modernization and growth, but these benefits arise only when the foundational work is done meticulously. Realistic demand forecasts, balanced financial structures, clear risk-sharing arrangements, robust regulation, phased development strategies, and strong social and environmental considerations form the backbone of a successful concession. A prudent, balanced, and well-negotiated concession not only protects public interests but also creates a stable foundation for a mutually beneficial partnership between public and private sectors.

Related : Exclusive : Suraya Yeasmin in interview to ALAM ALMAWNI

concession agreements , Suraya Yeasmin Jui ,Ports , Financial structuring , Prudent Preparation Matters , robust governance , governments ,

You Might Also Like

08 October 2025

07 October 2025

Recommendation News

Marine Tech

ABS and Fleetzero to Advance Battery Containers for Maritime Applications 15 January 2026

Yachts&Cruises

Majesty 100 Terrace First Hull Handed Over 08 October 2025

Shipping Lines

CMA CGM expands rail network linking Adriatic ports to Central Europe 11 November 2025

Marine Tech

Liberia strengthens top flag position in the world 05 December 2025

Shipping Lines

BIMCO: Crude tanker order book reaches nine-year high 19 November 2025