Recorded webinar: The Path to Maritime Cyber Resilience and Innovation

The global crude tanker order book has reached a nine-year high, climbing to 14.1% of the fleet after bottoming out at 2.8% in March 2023, according to Niels Rasmussen, Chief Shipping Analyst at BIMCO.

He notes that the trend follows low contracting volumes in 2022 and may mark the start of a fleet renewal phase, as the average age of crude tankers has increased since 2018. Since 2023, 325 crude tankers with a combined deadweight of 68.7 million tonnes have been contracted, bringing the current order book to 309 vessels totalling 65.8 million DWT.

China, South Korea and Japan dominate construction

China, South Korea and Japan dominate construction in the sector, with Chinese shipyards holding 60% of crude tanker capacity on order, South Korean yards 31%, and Japanese yards 8%; the remaining 2% is spread across facilities in the Philippines, Russia and Iran.

Deliveries are expected at 28.2 million DWT in 2027

Deliveries are expected to peak at 28.2 million DWT in 2027, and 98% of the order book’s capacity is due before the end of 2028. Suezmax and VLCC units account for most of the backlog with 135 and 128 ships respectively.

The order book’s scale

Rasmussen says the order book’s scale may appear disproportionate to expected oil demand growth. The International Energy Agency’s recent World Energy Outlook estimates that global oil demand will expand by a maximum of 0.7% annually between 2024 and 2035.

Related : BIMCO :Product tanker deliveries jumping 256% to 16-year high

Depending on decarbonisation progress

Depending on decarbonisation progress, the IEA projects annual growth of just 0.2% under its Stated Policies scenario, and a potential contraction of 3.3% per year if aligned with the Paris Agreement’s 1.5°C target.

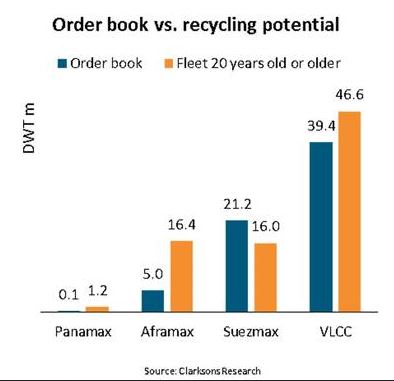

Given these forecasts, Rasmussen argues it will be critical for new ships to replace older, less efficient units rather than expand total capacity. Currently, 18.2% of the fleet is at least 20 years old, representing 17.2% of total DWT, making the recycling potential slightly larger than the order book. He adds that more than 40% of this potential relates to sanctioned ships, and that sanctions also limit the ability to sell these units, which could delay recycling and lead to lower recycling prices.

Recorded webinar

On the other hand BIMCO hosted Recorded webinar Michael Vrettos who is RINA Open Innovation Director, in Athens. He specialises in marine cybersecurity and collaborative innovation. He contributes to RINA Marine Cyber Security Services and international regulatory bodies, including IACS and EMSA. His career spans the EU, NATO, and the defence sector, where he has been actively involved in collaborative R&D projects bridging technology and cyber into operational and business context.

Related : RINA signs strategic green methanol agreement in China

Topics covered were:

Cyber & OT Risk Governance: Moving beyond structural oversight to embed cybersecurity across vessel design, build and operation.

Lifecycle Compliance in Action: Applying IACS UR E26/E27 from newbuild approvals to commissioning, testing, and in-service verification.

Innovation for Resilience: Leveraging AI and risk intelligence to turn regulatory compliance into day-to-day operational strength.

About :BIMCO

BIMCO is an international shipping association representing vessel owners, operators, managers, brokers and agents. It operates as a non-governmental organisation providing industry standards, market analysis, regulatory insight and contractual frameworks for the maritime sector.

Source : Press - Release

BIMCO ,The global crude tanker ,Crude tanker order ,nine-year high, Niels Rasmussen, RINA ,Michael Vrettos

You Might Also Like

29 October 2025

Recommendation News

Ports

Georgia Ports welcomes U.S.-India trade agreement 06 February 2026

Marine Tech

GNSS Interference in the Baltic Sea: A Collaborative Study 09 October 2025

Shipping Lines

BIMCO :Product tanker deliveries jumping 256% to 16-year high 19 October 2025

Marine Tech

Lloyd’s List : Top 10 shipbrokers 2025 - $1,54 - $ 7,94 billion 08 December 2025

Marine News Room

Pablo-Martini : An incredible collaboration is coming to an end. 24 October 2025