Sea-Intelligence suggests this imbalance could trigger a disorderly reintegration of these ports into Asia–Europe service networks, increasing the risk of terminal congestion as carriers rapidly

A return to Suez Canal routing could trigger a sharp and disorderly reset in Asia–Europe port connectivity, with Red Sea and East Mediterranean hubs facing sudden surges in traffic after prolonged suppression.In issue 748 of Sea-Intelligence Sunday Spotlight, Sea-Intelligence examined the potential effects of a return to Suez Canal routing on global port connectivity

Q4 2025 with pre-Red Sea crisis growth trends

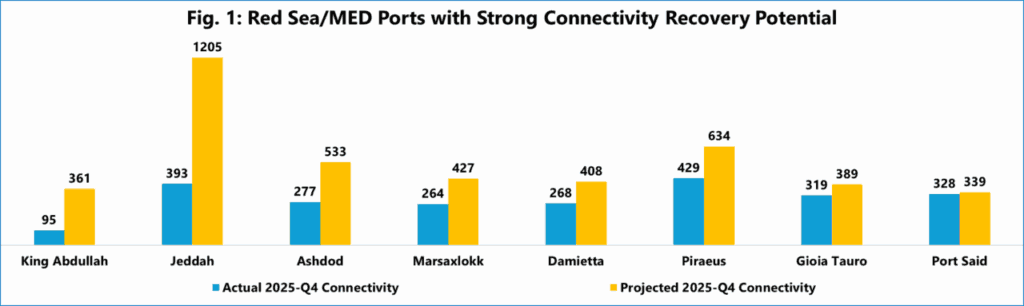

Comparing connectivity levels in Q4 2025 with pre-Red Sea crisis growth trends from Q3 2022 to Q3 2023, the analysis shows that most major ports in the Red Sea and East Mediterranean remain well below expected connectivity levels. The data indicates that a reopening of Suez is unlikely to result in a smooth, incremental recovery. Instead, Sea-Intelligence points to the likelihood of a sharp correction in these regions as services are reinstated. Figure 1 sets out the “recovery potential” for key ports, defined as the gap between actual connectivity in Q4 2025 and projected connectivity had the crisis not occurred

.An abrupt rebound concentrated

Rather than a gradual normalisation, the data point to an abrupt rebound concentrated in specific gateways The scale of the gap, defined as “recovery potential”, reflects the difference between current connectivity and the projected 2025-Q4 level implied by the pre-crisis trajectory.

Saudi Ports

The scale of the gap is pronounced. King Abdullah Port currently records a connectivity score of 94.7, compared with a projected 361.5 — implying a recovery potential of 282 per cent. Jeddah shows a similar pattern, with a gap of 206 per cent. Suppressed connectivity also extends into the East Mediterranean, where Ashdod remains 92.4 per cent below its projected level and Damietta by more than 50 per cent. Ports such as Dammam and Colombo have recorded structural connectivity gains during the crisis, underpinned by infrastructure investment and deeper network integration.

Sea-Intelligence suggests

Sea-Intelligence suggests this imbalance could trigger a disorderly reintegration of these ports into Asia–Europe service networks, increasing the risk of terminal congestion as carriers rapidly reactivate loops. The analysis also notes that the post-crisis Asia–Europe network is unlikely to fully revert to its 2023 configuration. These gains appear durable, pointing to a higher long-term baseline even after Suez routing resumes.

About Sea-Intelligence

Sea-Intelligence is a leading provider of Research & Analysis, Data Services, and Advisory Services within the global supply chain industry, with a strong focus on container shipping. Combining strong quantitative analytical skills with a deep understanding of the supply chain industry, based on many decades of experience at all central parts of the Ocean supply chain, Sea‑Intelligence supports customers across all stakeholder groups.

Related :Rabie : Positive indicators suggest a recovery in canal traffic in the coming period.

#Sea-Intelligence #King Abdullah Port #Suez Canal #Saudi Ports #East Mediterranean #Asia–Europe port

You Might Also Like

09 November 2025

Recommendation News

Shipping Lines

GEODIS : Laura Ritchey a President & CEO of Americas Region 15 October 2025

Yachts&Cruises

Stena Line Celebrates launch of hybrid ferry Stena Futura in Belfast 22 November 2025

Marine News Room

Dawicki : “HALO° System is revolution in Maritime Education 20 October 2025

Marine Tech

LR issues first Guidance Notes for onboard hydrogen generation as industry seeks regulatory clarity 03 February 2026

Marine Tech

IMO : Mexico prepares for green shipping future 14 October 2025