Despite the end of Houthi attacks, Suez Canal traffic hasn't fully rebounded. Shipping alternatives remain prevalent

A greater resumption of shipping routes between the Suez Canal and the Red Sea is the decline in war risk insurance premiums in the Red Sea.

Despite all these reports and indicators, there is now more optimism when a viewpoint is provided to the website Argus "Spot bunker demand at the Suez Canal could strengthen in 2026 as the prospect of improved security conditions in the Red Sea prompts major shipowners to weigh a return to the route. " It is noteworthy that the Yemen-based Houthis signalled a pause to their maritime attacks in the Red Sea on 11 November, following a peace agreement signed between Israel and Palestinian militant group Hamas a month earlier. But they warned attacks would resume if fighting in Gaza restarts.

(SCA) has said the route is ready to receive container ships

Since then, the Suez Canal Authority (SCA) has said the route is ready to receive container ships and has held talks with major carriers including Maersk and CMA CGM. The SCA has also introduced flexible pricing, including a 15pc discount for container ships over 130,000t. Some large container vessels have already transited, such as the 396m CMA CGM Jules Verne with a gross tonnage of 176,000t.

Averaged $550.75/t and Suez $635/t

Argus assessed delivered very-low sulphur fuel oil (VLSFO) in Cape Town at an average of $612.25/t between 8 January and 8 December 2025, while Durban averaged $598.75/t. By comparison, Port Said averaged $550.75/t and Suez $635/t over the same period, the latter reflecting higher operational costs and limited supplier activity.

A sustained return of large shipowners would lift bunker demand at Suez, reversing the shift to southern Africa ports seen since late 2023 when the Houthi attacks began. Smaller shipowners could follow, but they would need insurers to cut premiums, which remain high because of the attacks.

The longer route

The longer route has lifted bunker fuel consumption and operational expenses for shipowners. Some bunker fuel suppliers have shifted to Egypt's Port Said and paused Suez operations, but one told Argus they are already planning a return and arranging replenishments.

Related : Suez Canal : The passage of the giant container ship CMA CGM JULES VERNE

Cape of Good Hope route

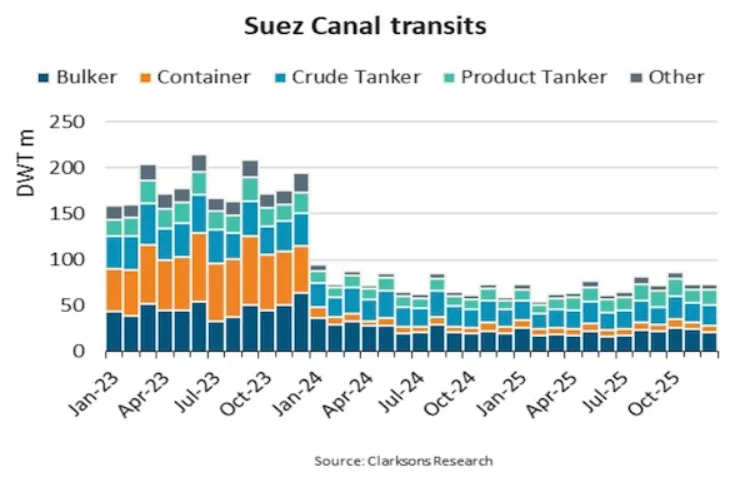

Shipping firms have increasingly switched to the longer Cape of Good Hope route since the attacks started, adding weeks to east-west voyages. In the third quarter of 2025, 3,277 vessels passed through the Suez Canal, down from 6,253 in the same period of 2022, SCA data show.

Geopolitical events impacted traffic through Canal Suez transit

Meanwhile, geopolitical events impacted traffic through Cana.Suez transit tonnage in early May this year was about 70pc below the 2023 average, according to UN Trade and Development's 2025 Review of Maritime Transport. The rerouting boosted spot demand at Cape Town and Durban on South Africa and Port Louis in Mauritius. Spot demand at Cape ports could fall if ships return to Suez, potentially easing bunker prices in southern Africa, market participants said.

According to the latest data

Recent geopolitical developments in the region have led to confirm that there is still a long way to go before life returns to normal in the Suez Canal. Shipping traffic remains very low, despite more than three months having passed since the last Houthi attack on commercial vessels in the Red Sea. According to the latest data from the General Authority for Ports and Maritime Navigation (PIMCO), the number of ships crossing the canal in the first week of 2026 was about 60% lower than in the same period of 2023, before many companies began changing their routes around the Cape of Good Hope to avoid security risks.

Resumption of the Suez Canal route

Maritime experts and analysts do not expect a quick resumption of the Suez Canal route, citing several factors, including the complexity and time required to adjust networks, the risk of renewed attacks, and potential port congestion if the return occurs simultaneously. Despite this, the largest container ships of the French company CMA CGM as well as a container ship of the Danish company Maersk, successfully passed through. However, in the final months of 2025, the first signs of a return, albeit cautious, emerged. Some shipping companies tested the Suez Canal route:

Adjusting ocean carrier networks

On the other hand Alan Murphy, founder and CEO of Sea-Intelligence, stated, adjusting ocean carrier networks is a complex process that requires time. Reinstating a single weekly service via the Suez Canal would require rerouting twelve out of fourteen vessels on a 98-day round trip. The last recorded incident dates back to September 29, 2025, when the Minervagracht was the last vessel attacked by the Houthis. Forty-three days after that attack, the group announced a halt to its attacks on ships, but maritime traffic has not seen a significant increase.

However, in the final months of 2025, the first signs of a return, albeit cautious, emerged. Some shipping companies tested the Suez Canal route: CMA CGM announced that its Medex and Indamex services would resume transiting the canal starting in January 2026. Furthermore, on December 19, 2025,This opens the door to the possibility of a gradual return to the traditional path if security conditions allow it.

War risk insurance premiums

Another factor that could contribute to a greater resumption of shipping routes between the Suez Canal and the Red Sea is the decline in war risk insurance premiums in the Red Sea. In early December, these premiums fell to around 0.2% of the ship's value, their lowest level since the start of the tensions, thus reducing some of the additional costs that had prompted many companies to opt for longer routes.

Localize the maritime industry

But despite all these geopolitical repercussions in the region, there is noticeable activity at the Suez Canal Authority, and the crisis has created many opportunities, including in this vital sector of the shipbuilding industry and other of projects . Yesterday, the Authority] inspected [the shipbuilding facilities ِAdmiral Osama Rabie, Chairman of the Suez Canal Authority SCA , inspected the construction work of the various marine units being built at the South Red Sea Shipyard Company, to assess the progress rates and implementation schedules, and to follow up on the work and preparation work at the tourist yacht factories of the Suez Canal Modern Boats Company in Safaga

This comes as part of the partnership between the Suez Canal Authority SCA and the South Red Sea Shipyard Company, within the framework of efforts to localize the maritime industry and strengthen partnerships with the private sector.

Related : Suez Canal : Transit of the giant container ship CMA CGM JACQUESSAADE and MAERSK SEBAROK

#Admiral Osama Rabie #South Red Sea Shipyard #CMA CGM. #Suez Canal #Alan Murphy #(PIMCO) #Argus:#Maersk #Suez bunker

You Might Also Like

Recommendation News

Shipping Lines

Noble Corporation plc to announce fourth quarter and full year 2025 results 05 February 2026

Incidents

Video: Explosions near Port Sudan Airport and Port 17 October 2025

Incidents

Over 50 Cruise Passengers Rescued After Catamaran Sinks In Samaná Bay 15 November 2025

Incidents

Panama-flagged ATA 1 towed to safe anchorage after engine failure in Çanakkale Strait 09 December 2025

Marine Tech

IMO : First maritime technical workshop for Latin America and the Caribbean 30 October 2025