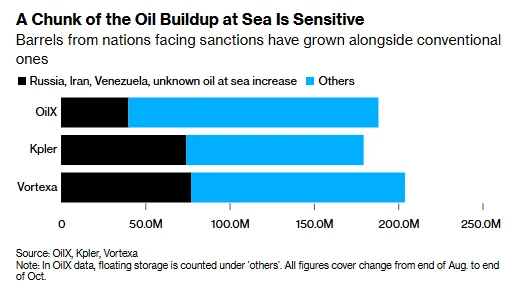

Shipments from Russia, Iran, Venezuela, and of unknown origin represent 40% of the accumulated supplies since the end of August.

According to Zhitong Finance APP, currently, the accumulation of nearly one billion barrels of crude oil are stranded at sea globally, with an unusually high proportion originating from sanctioned countries. This indicates that sanction measures are significantly disrupting the oil trade.

Poses a threat to the revenues of sanctioned oil-producing countries

This accumulation does not necessarily mean these barrels will ultimately go unsold, but it poses a threat to the revenues of sanctioned oil-producing countries, with broader implications for the global oil market, which is already projected to be heading toward a supply glut. While this increase partly reflects higher production, it also points to difficulties in unloading shipments. Simultaneously, a similar increase in non-sanctioned supplies has also occurred.

Vessel tracking data

Where vessel tracking data from Vortexa, Kpler, and OilX shows that since the end of August, crude oil inventories aboard tankers have surged significantly. Crude oil produced by or sourced from Russia, Iran, and Venezuela, or of unknown origin, accounts for up to approximately 40% of this increase. Even under the most conservative estimate of 20%, this share still exceeds these three countries' combined share of global crude oil production.

Oil price trends in the coming months

Traders say that regardless of whether the crude oil is affected by sanctions, its final destination will largely determine oil price trends in the coming months. Cautious sentiment triggered by the latest Western sanctions is causing a realignment in crude flows, creating ripple effects on major importers such as India and China. Additionally, tight tanker capacity has driven daily freight rates above $100,000 at times.

Tighter Western sanctions

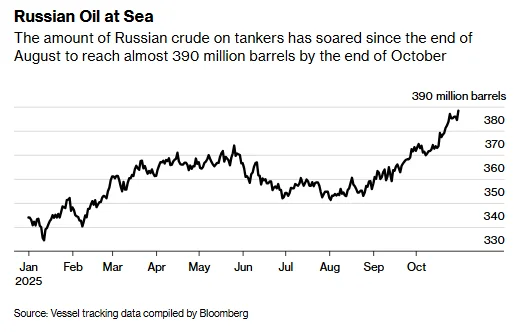

Analysts including Frode Morkedal at Clarksons Securities wrote: 'Some of the inventory growth stems from tighter Western sanctions, leaving Russian crude stranded on ships unable to be discharged. Previous buyers have shifted to sourcing alternative crude from the Middle East and the Atlantic region.'Analysis of vessel tracking agency data shows that the backlog of restricted crude oil is primarily attributed to Russian supply.

Russia’s seaborne oil transportation volume

In recent weeks, Russia’s seaborne oil transportation volume has risen. As the country and its OPEC+ allies gradually unwind previous production cuts, oil output continues to increase. Furthermore, Ukraine’s attacks on Russian oil infrastructure, particularly refineries, may have led to some crude being redirected to export terminals.

Indian refineries have evidently paused receiving Russian crude

At the same time, unprecedented pressure was exerted by Western countries on buyers of Russian crude oil, resulting in some cargoes being unable to be unloaded – Indian refineries have evidently paused receiving Russian crude, and there are indications that China may also be reluctant to take over all supplies. Sanctions imposed by the United States on Russia’s two major oil producers, Rosneft PJSC and Lukoil PJSC, have further complicated their crude oil trading.

Iranian oil exports have also surged significantly,

According to calculations based on data from Russia's Ministry of Finance, oil-related tax revenues in Russia fell by more than 24% year-on-year last month. The Russian government has forecasted that this year’s oil and gas-related funds flowing into the budget will drop to their lowest level since the pandemic in 2020.

Iranian oil exports have also surged significantly, reaching their highest level in seven years in October. Coincidentally, the U.S. imposed sanctions on a major terminal that month, accusing it of participating in the procurement of Iranian crude oil and providing financial support to the Iranian regime.

Related : Tanker prices rise after latest US sanctions against Russia

Offshore crude data includes confirmed shipments

OilX, part of the energy consultancy Energy Aspects, stated that its offshore crude data includes confirmed shipments, including those from Iran, Venezuela, and other countries – where delays often occur due to activities of the 'shadow fleet' – meaning the relevant figures may be revised upwards over time. Vortexa, on the other hand, noted that its offshore crude data tends to be overestimated and usually undergoes downward revisions as vessels discharge, though the current situation is far from normal.

Surge in Supply

Admittedly, with the increase in global oil production, there is also a significant amount of crude not subject to sanctions aboard tankers at sea. OilX data shows that since the end of August, the largest single contributor to inventory increases has been Saudi Arabia, followed closely by the United States and Russia.

Last month, Saudi Arabia shipped oil overseas at the fastest rate in two and a half years, steadily reclaiming market share lost due to years of participation in OPEC+ production limits.

Meanwhile, U.S. offshore crude inventories have also risen. In October, U.S. crude exports reached their highest monthly average since July 2024, driven by Asian refiners purchasing large quantities of U.S. crude during the summer when Middle Eastern oil prices were relatively higher compared to other regions (a phenomenon known as the arbitrage window).

However, OilX data shows that sanctioned countries, which account for approximately 17% of global crude oil production, represent a disproportionately large share of the recent increase in offshore crude volumes.

Brian Mandell, Executive Vice President of Marketing and Commercial at Phillips 66 (PSX.US), stated during the earnings call at the end of last month: “There is indeed a significant backlog of crude oil at sea currently, and we are waiting to see where this crude will eventually go.”

ٍSource : Futubull

barrels of crude oil ,Brian Mandell,OilX data , Frode Morkedal , offshore crude data ,Zhitong Finance APP ,Western sanctions , Iranian oil , U.S. offshore crude , Russian crude oil ,Indian, Billions At the Sea

You Might Also Like

07 October 2025

10 November 2025

Recommendation News

Shipping Lines

ASMO Expands Procurement Services for Aramco 30 October 2025

Marine News Room

Pablo Rodas-Martini writes : A penguin and (ALS) system 27 October 2025

Shipping Lines

GEODIS achieves WHO GDP certification for its hub in Korea 06 February 2026

Shipping Lines

Maersk deploys first vessel in new mid-size class 03 February 2026

Incidents

Sharjah confirms full containment of Al Hamriyah Port fire 17 October 2025